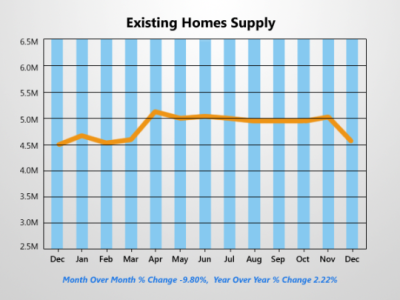

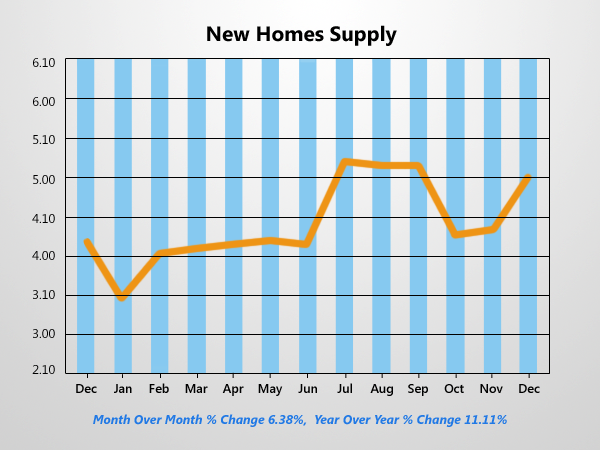

Rising mortgage rates will tame the enthusiasm of some home buyers. But the lack of choice when choosing a home will also hinder buying. Inventory levels are already essentially at a 50-year low. Existing home inventory is hovering at a 13-year low. Total housing inventory at the end of December fell 9.3% to 1.86 million existing homes available for sale, which represents a 4.6-month supply at the current sales pace, down from 5.1 months in November.

[tabs style=”1″][tab title=”Existing Homes Supply”]

[/tab] [tab title=”New Homes Supply”]

[/tab] [tab title=”Existing Homes Inventory”]

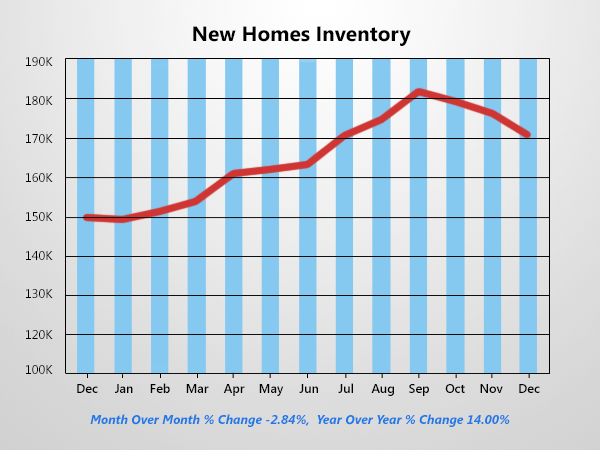

[/tab] [tab title=”New Homes Inventory”]

[/tab] [/tabs]

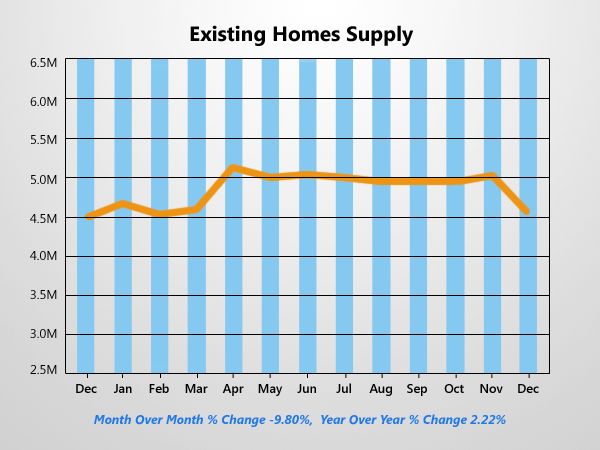

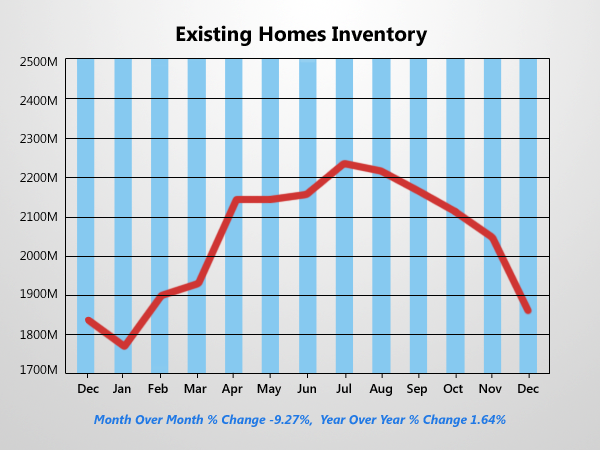

Unsold inventory is 1.6% above a year ago, when there was a 4.5-month supply. Increases from housing starts will bring more inventory to the market. But the current production of little over a million is not sufficient. Another quick ramp up of around 40% to 50% is needed to adequately supply the market.

Another source of potential inventory is the shadow inventory of homes whose mortgages have not been paid, is delinquent or the home is already in the foreclosure process. As it stands the shadow inventory situation has improved in many markets, however not all markets are out of the woods yet. Naturally, fast price appreciating markets such as California and Nevada would like to have more inventory, but the shadows in these states have been greatly depleted

Distressed homes – foreclosures and short sales – accounted for 14% sales last month, unchanged from November; they were 24% in December 2012. The shrinking share of distressed sales accounts for some of the recent price growth. Ten percent of sales were foreclosures, and 4%were short sales. Foreclosures sold for an average discount of 18% below market value in December, while short sales were discounted 13%.

At the other end of the spectrum, slow price appreciating states have no need for additional supply. Yet, states like New Jersey, New York, and Connecticut have barely dented their shadow and these distressed homes still loom over the market. These states have only reduced their shadow by around 10% from the peak condition. Inventory is tightest in the West, which is holding down sales in many markets, and multiple bidding is causing it to experience the strongest price gains in the U.S. The median price in the West was $285,000, up 16.00% from December 2012.

The median time on market for all homes was 72-days, up sharply from 56-days in November, but slightly below the 73-days on market at the end of 2012. Adverse weather reportedly delayed closings in many areas. Twenty-eight percent of homes sold were on the market for less than a month, down from 35% in November, which appears to be a weather impact. Short sales were on the market for a median of 122-days, while foreclosures typically sold in 67-days and non-distressed homes took 70-days. First-time buyers accounted for 27% of purchases, down from 28% in the month previous and 30% in 2012 respectively. All-cash sales comprised 32% of transactions, unchanged from a month earlier; they were 29% in 2012. Individual investors, who account for many cash sales, purchased 21% of homes, up from 19% in November, but are unchanged from December 2012.